What are natural gas futures?

The natural gas futures market is well-established and allows traders to exploit unique opportunities in the supply and demand of natural gas. As a highly liquid market, natural gas futures provide an efficient trading alternative to energy stocks and ETFs for those looking to diversify their portfolio beyond the major market stock indexes.

The economic activity resulting from the global natural gas industry has emerged as a cornerstone of the global energy markets. Natural gas can profoundly influence the economic dynamics of almost every country in the world. More efficient gas extraction techniques and the ability to transport natural gas as liquefied natural gas have allowed many more countries to utilize this beneficial natural resource and have established natural gas as a vital global trading market.

Why Trade Natural Gas Futures?

The natural gas futures (contract symbol = NG) market is well-established, giving traders the opportunity to speculate on the price of natural gas. The global nature of the natural gas market, with its many complexities, can offer a variety of trading benefits including:

Direct exposure to speculate on price of natural gas movement

Increased flexibility versus trading natural gas stocks or ETFs

Virtually 24-hour access to highly liquid, cost-effective trading

Diversified trading uncorrelated to major market stock indexes

Trade Micro Natural Gas Futures to Reduce Costs

At 1/10th the size of the standard contract, Micro natural gas futures allow traders like you to access the energy futures marketplace with a reduced financial commitment. Other advantages of trading micro natural gas futures include:

- The ability to target opportunities in a popular energy market

- Highly leveraged investment for more buying power

- Reduced financial commitment vs. a larger natural gas contract

- Increased flexibility for position management

Leverage also increases the risk associated with futures trading and only risk capital should be used for trading

Who Trades Natural Gas Futures?

Natural gas futures traders can be broken down into three main groups:

- Commercial traders typically trade futures to hedge the price of natural gas for their business interests. For example, countries and large gas drilling companies with substantial gas reserves in the ground, like China, Russia, and the US will sell futures contracts to lock in prices when natural gas prices are elevated. Companies and countries that produce electricity will buy futures contracts to lock in prices when natural gas prices are lower than expected.

- Large professional speculators are usually commodity pool operators, proprietary trading firms, institutional investors, large CTAs, and hedge funds. These traders are purely speculating on the price movement of natural gas and generally do not take physical delivery. Typically, commercial traders and large speculators make up 85% or more of the daily trading volume in natural gas futures.

- Self-directed retail traders make up the remaining daily trading volume in natural gas, and like large speculators, rarely take actual delivery of natural gas. To prevent the possibility of physical delivery, they usually choose to close their future contracts prior to the first notice date.^

What Can Affect The Price Of Natural Gas Futures?

The price of natural gas is influenced by a variety of both short-term and long-term economic and fundamental factors. Geopolitical events, alternative energy sources like renewables, environmental policy and regulations, and the growing worldwide energy infrastructure all play a part in the daily price of natural gas futures.

Global Economics

Global natural gas prices are often quoted and transacted in US dollars, and the strength or weakness of the dollar can influence the price of natural gas. A stronger dollar might make natural gas more expensive for foreign buyers, potentially reducing demand and prices. The health of the global economy can also influence the demand for natural gas. Economic downturns typically decrease energy consumption, leading to reduced demand for natural gas and potentially lower prices.

Production Levels

Advances in extraction technology, like hydraulic fracturing (fracking), have increased natural gas production in many places around the world. Higher production can also lead to oversupply, which can lower prices.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Risks of Natural Gas Futures Trading

The primary risk of trading natural gas futures is that the price will go against the trader’s position. Having a risk management plan that includes stop losses or a trailing stop, along with appropriate trade sizing can help reduce your financial exposure.

As it is a global marketplace, it is important to keep abreast of economic activity and news that may affect and influence natural gas futures including supply and demand data, US dollar index directional trend, and international and domestic energy reports.

Tips to keep in mind especially for newer futures traders include:

- Practice in a futures trading simulator which reflects live market conditions until you prove to yourself that you are comfortable with the market swings. Then, when you do start trading with real dollars, trade small to start, and work your way up.

- Build a well-defined futures trading plan including clear entry and exit criteria, analysis of market conditions and a schedule for when you are and are not going to trade.

Natural Gas Henry Hub Futures Contracts Specifications

Natural gas futures are standardized exchange-traded contracts that represent 10,000 MMBtu (million British thermal units) or 1,000 MMBtu of gold (Micro contract). There are two Ms because an M = 1,000 in Roman numerals, so M x M = 1 million. 1 MMBtu is roughly 1,000 cubic feet of natural gas, so one contract is approximately 10 million cubic feet.

Retail traders typically buy and sell natural gas futures contracts to speculate whether the price will go up or down and typically do not take delivery of the physical natural gas. A Henry Hub natural gas futures contract is between a buyer and seller, with a set price that is determined when the position is entered and expires on a future date.

| Standard Contract | Micro Contract | |

|---|---|---|

| Symbol | NG | MNG |

Exchange | NYMEX | NYMEX |

| Contract point value | 10,000 MMBtu | 1,000 MMBtu |

| Minimum price fluctuation | .001, (10,000 * .001 = $10.00 per-contract per-minimum move) | .001, (1,000 * .001 = $1.00 per-contract per-minimum move) |

| Trading hours | Sunday 6:00 pm ET to Friday 5:00 pm ET | Sunday 6:00 pm ET to Friday 5:00 pm ET |

| Listed contracts | Monthly contracts listed for the current year and the next 12 calendar years. Jan.(F), Feb.(G), Mar.(H), April(J), May(K), June(M), July(N), Aug.(Q), Sept(U), Oct.(V), Nov.(X), Dec(Z). | Monthly contracts listed for 24 consecutive months |

| Expiration style | Trading ceases on the third last business day of the month prior to the contract month. | Trading terminates on the 4th last business day of the month prior to the contract month. |

| First notice date^ | One trading day after last trading day | N/A |

| Settlement | Deliverable | Financially settled |

| Additional Specifications | View all from CME Group | View all from CME Group |

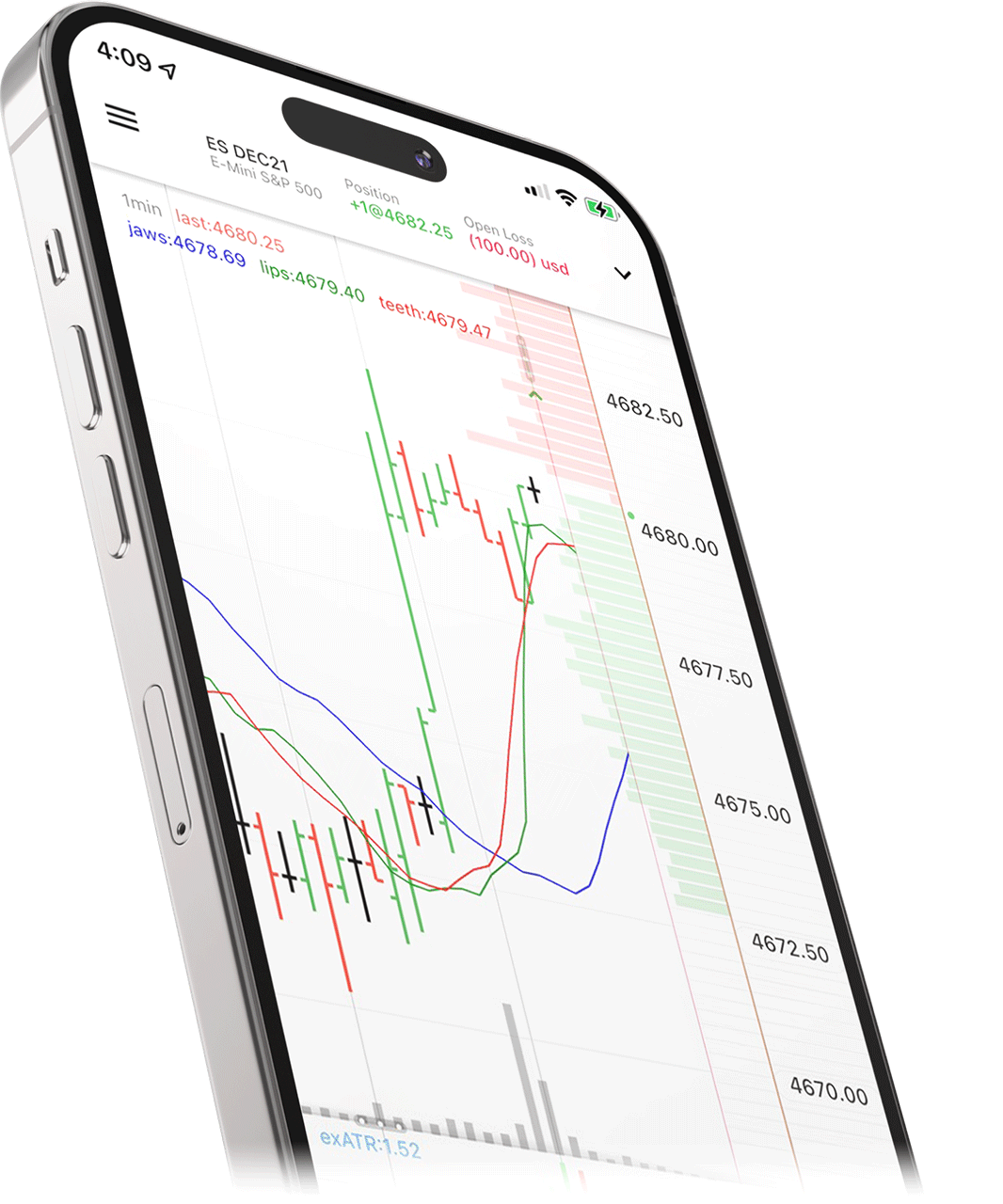

Become A Natural Gas Futures Trader Today

Ready to start trading natural gas? NinjaTrader is here to support you. With award-winning features and daily premium market commentary with industry pros, NinjaTrader equips you with the tools you need to embark on your trading journey.