Understanding order placement in futures trading

When trading futures, you can profit when a contract you purchased increases or decreases in price.

- If you take a “long” position, that means you expect the price of the contract to increase.

- If you take a “short” position, that means you expect the price of the contract to decrease.

Let’s take a look at some futures order entry basics and explore the various order entry types available to futures traders.

Buy or sell: You decide

There are two order actions in futures trading:

- A buy order allows you to enter a new long position, add to an existing long position, reduce an existing short position, or close an existing short position.

- A sell order allows you to enter a new short position, add to an existing short position, reduce an existing long position, or close an existing long position.

Once you place an order, it is sent to the applicable futures exchange which serves as the centralized electronic marketplace for futures trading. The exchange “matches” buyers and sellers meaning that for every buy order or sell order you submit, another trader is taking a position on the opposite side. This creates a fair and transparent trading environment with the exchange guaranteeing all transactions.

Determine the order price

When placing an order, you need to determine the order price at which your order can be “filled”. Filled means that your submitted order request has been matched by the exchange with another trader choosing to take the opposite position (i.e. long or short).

The price at which you can buy or sell a futures contract is based on the current bid and ask prices.

- The bid price is the current highest limit order price where someone is willing to buy.

- The ask price is the current lowest limit order price where someone is willing to sell.

3 Basic Order Types In Futures Trading

Before placing a trade, you will have to decide on the order type you would like to submit to the exchange. The trader can control under what conditions and at what price an order will be filled using one of the three basic order types: market, limit or stop market orders.

Market orders

The fastest and easiest way to enter or exit a futures position is with a market order. A market order is executed as soon as it reaches the exchange.

- Buy market orders are filled and matched against the current best ask price.

- Sell market orders are filled and matched against the current best bid price.

Limit orders

Limit orders can be used to enter a new position or to exit an existing position with a profit. Limit orders are conditional orders that are filled when the current market price trades at or past the limit price set when the trade was submitted.

When placing a buy limit order, the limit price must be below the current market price. In a similar fashion, when placing a sell limit order the limit price must be above the current market price.

Stop market orders

Stop market orders can be used to enter a new position or to exit a position protecting against losses. Stop orders are conditional orders that are filled at market when the current price trades at or past the specified stop price set when the trade was submitted.

When placing a buy stop order, the stop price must be above the current market price. Alternatively, when placing a sell stop order, the stop price must be below the current market price.

Develop The Trader In You

Get started on your path to learning how to trade futures through our introductory video series which introduces the basics and key take-aways for your journey.

Order Details Required For A Futures Trade

Every time you place an order into the market, you will need to specify the following order parameters:

- The symbol to trade

- The order type: market, stop, or limit

- The order quantity in number of contracts

With the order parameters in place, you can now choose to enter or exit a position using the buy or sell order buttons.

Practicing trading in NinjaTrader’s risk-free simulation environment is an ideal way to build familiarity with both these required parameters and the tools available to submit your trades.

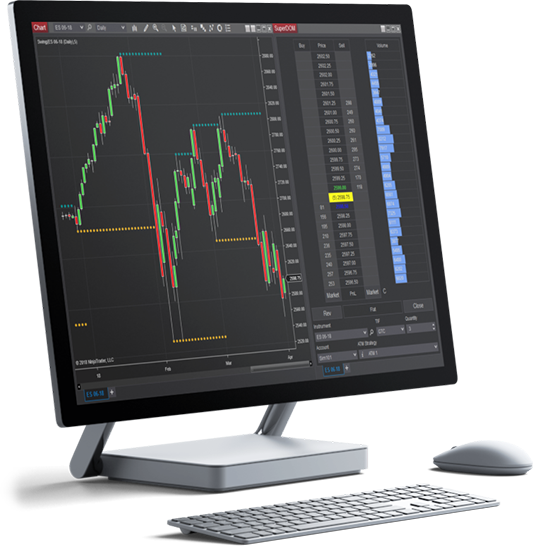

Using NinjaTrader platforms to manage a futures order

Once you've identified a potential trade opportunity and are ready to place an order, you can select from a number of intuitive order entry tools available in the NinjaTrader platforms. Any one of these tools will make the process fast and easy to place your trades and track your positions.

- Basic order entry

- Chart Trader

- SuperDOM

Visit our New User Video Guides for tips to get started with your preferred order entry method. As you build your trading experience, Advanced Trade Management (ATM) strategies are also available in NinjaTrader Desktop that allow you to manage orders automatically based on predefined settings.

Best Brokerage for Trading Futures

NinjaTrader is recognized for our unique combination of a high-performance trading platform, discount pricing, and real-time support.

Download NinjaTrader's award-winning software for FREE and see why it's consistently voted an industry leader by the trading community. NinjaTrader is always free to use for advanced charting, backtesting and trade simulation.