What Are E-Mini S&P 500 Index Futures?

The E-mini S&P (Standard and Poor’s) 500 index futures are the most actively traded futures contract. Founded in 1957, the S&P 500 index is regarded as a key benchmark for the U.S. stock market and plays an essential role in the global financial markets.

The S&P 500 index is a cap-weighted index, which means each stock’s influence on the index price is determined by market capitalization giving greater weight to larger companies. The performance of these larger stocks has significant impact on the overall price movement of the index which makes the S&P 500 index a key indicator of the US stock market's overall strength and directional trend.

Why Trade E-Mini S&P 500 Index Futures?

The E-mini S&P 500 index futures (contract symbol = ES) is a derivative of the S&P 500 index. It provides traders direct exposure to speculate on the combined price of the 500 largest market-capitalized companies listed on US stock exchanges including household names like Apple, JPMorgan Chase, and Johnson & Johnson.

Benefits of trading E-mini S&P 500 futures include:

Easily go long or short based on your own view of upcoming stock market performance.

Hedge a stock portfolio against market declines for short or long periods of time.

React quickly to trading opportunities and breaking news before the stock market opens.

Flexible contract sizes allow you to start small with Micro contracts and scale up your positions.

Trade Micro E-mini S&P 500 Index Futures To Reduce Costs

At 1/10th the size of the E-minis contract, Micro E-mini futures allow traders to access the highly liquid equity index futures markets with reduced costs including only $50 margins. Other advantages of trading these bite-sized contracts include:

- Access to the most popular and liquid futures contracts

- Highly leveraged investment for more buying power*

- Reduced financial commitment vs. the E-mini contract

- Increased flexibility for position management

Micro E-mini futures contracts provide an ideal starting point for new futures traders to start small and scale up as you become more comfortable in the live markets.

*Leverage also increases the risk associated with futures trading and only risk capital should be used for trading

Who trades E-mini S&P 500 index futures?

E-mini S&P 500 futures contract traders can be broken down into three main groups:

- Commercial traders are typically trading index futures to hedge their price risk on a large portfolio of stocks. These traders are typically large banks, pension funds, mutual funds, or other institutional investors.

- Large professional speculators are typically speculating on the price movement of the E-mini S&P 500 futures contract. Typically, commercial traders and large speculators make up 85% or more of the daily trading volume in the E-mini S&P 500 futures.

- Self-directed retail traders make up the remaining daily trading volume in E-mini S&P 500 index futures and, like large professional traders, typically speculate only on the price movement of the futures contract. Many use analytical tools, such as an E-mini S&P 500 futures chart, to inform their decisions.

What Can Affect The Price Of E-mini S&P 500 Index Futures?

Although the E-mini S&P 500 futures are made up of the largest 500 stocks, the top 50 stocks account for over 50% of the price action each day. This means that earnings and news events in any of these top key component stocks can have a large, disproportionate effect on the index price.

Macroeconomic Factors

Economic indicators such as GDP growth, inflation rates, and employment data can have a significant influence on market sentiment and investor confidence. Positive economic data, such as strong GDP growth or declining unemployment rates, can drive prices for the E-mini S&P 500 index futures higher. Of course, negative economic data can lead to a decline in prices as investors become more cautious and risk averse.

Interest rates and FED policy

Changes in interest rates and monetary policy decisions can also impact the price of S&P 500 index futures. When interest rates are low, it can stimulate borrowing and investment, which tends to boost stock prices. On the other hand, when interest rates rise, borrowing becomes more expensive, potentially reducing economic activity and causing stock prices to decline.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Risks of E-mini S&P 500 Futures Contract Trading

The primary risk of trading E-mini S&P 500 futures is that the price of the index future will go against the trader’s position. When trading E-mini S&P 500 futures, it can be easy for traders to get caught up in the excitement of the price action.

Using appropriate trade sizing for your account size and having a robust trading risk management plan in place that includes stop losses or a trailing stop can go a long way in helping to reduce your overall risk exposure.

Tips to keep in mind especially for newer futures traders include:

- Practice in a futures trading simulator which reflects live market conditions until you prove to yourself that you are comfortable with the market swings. Then, when you do start trading with real dollars, trade small to start, and work your way up.

- Build a well-defined futures trading plan including clear entry and exit criteria, analysis of the market conditions and a schedule for when you are and are not going to trade.

- Keep abreast of economic activity that may move the major stock market indexes, including changes in interest rates, economic reports, and international and domestic news.

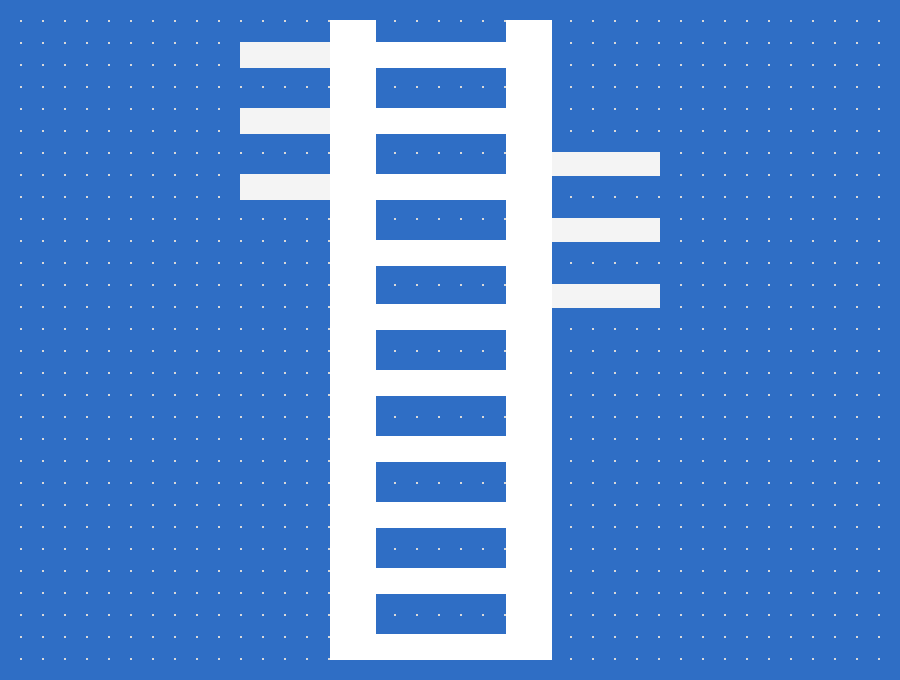

E-Mini S&P 500 Index Futures Contracts Specifications

| Standard E-mini S&P 500 Index Futures | Micro E-mini S&P 500 Index Futures | |

|---|---|---|

| Symbol | ES | MES |

Exchange | CME GLOBEX | CME GLOBEX |

| Contract point value | $50 USD | $5 USD |

| Minimum price fluctuation | .25, (50 * .25 = $12.50 per contract per-minimum move) | .25, (5 * .25 = $1.25 per-contract per-minimum move) |

| Trading hours | Sunday 6:00 p.m. ET to Friday 5:00 p.m. ET | Sunday 6:00 p.m. ET to Friday 5:00 p.m. ET |

| Listed contracts | Quarterly: March(H), June(M), September(U), December(Z) - nine quarters out and three additional December contracts | Quarterly: March(H), June(M), September(U), December(Z) - five quarters out |

| Expiration style | 3rd Friday of every listed contract month. There is not a first notice date for this contract. | 3rd Friday of every listed contract month. There is not a first notice date for this contract. |

| Settlement | Financially settled | Financially settled |

| Additional Specifications | View all from CME Group | View all from CME Group |

Become an E-Mini S&P 500 Index futures trader today

Ready to start trading E-mini index futures and Micro index futures? NinjaTrader is here to support you. With award-winning features and daily premium market commentary with industry pros, NinjaTrader equips you with the tools you need to embark on your trading journey.