What are silver futures?

Silver futures allow you to trade on the price and future performance of silver. As a more efficient alternative to trading silver coins or bullion, silver futures can help diversify your trading portfolio.

Silver is highly prized for its utility and durability and is essential in a wide range of manufacturing processes including electronics, medicine, automotive, fine jewelry, and art. These uses, along with its role as a storage of wealth, make silver futures an important instrument for traders worldwide.

Why Trade Silver Futures?

Silver futures (contract symbol = SI) offer traders an opportunity to diversify their trading portfolios as silver is generally uncorrelated to equity and other futures markets. Benefits of trading silver futures include the ability to:

Capitalize on unique opportunities with nearly 24-hour trading

Participate in the silver marketplace in a cost-effective way

Trade on a level playing field with transparent price and volume data

Go long and short easily with no restrictive day trading rules

Trade Micro silver futures to reduce financial commitment

At 1/10th the size of standard silver futures contracts, Micro silver futures contracts allow traders to access dynamic markets with lower costs and reduced day trading margins. Other advantages of trading Micro silver contracts include:

- Increased flexibility to scale in and out of positions

- Ability to manage trade risk more precisely

- Highly leveraged instrument for more buying power

Leverage also increases the risk associated with futures trading and only risk capital should be used for trading.

Who trades silver futures?

Silver futures traders can be broken down into three main groups:

- Commercial traders typically trade futures to hedge the price of silver. For example, silver mining companies who trade futures are hedging known silver reserves that are yet to be mined. Commercial traders are also industrial companies that use large amounts of silver in the manufacturing process of jewelry, medicines, and electronics. Commercial traders will often take delivery of silver.

- Large professional speculators are typically commodity pool operators, proprietary trading firms, institutional investors, and hedge funds. These traders are purely speculating on the price movement of silver and generally do not take delivery or hold actual silver. Normally, commercial traders and large speculators make up 80% or more of the daily trading volume in silver futures.

- Self-directed retail traders make up the remaining daily trading volume in silver and like large speculators, rarely take actual delivery of silver, choosing instead to close their future contracts.

What impacts the price of silver futures?

Silver is a global market with several complex pricing dynamics that can be influenced by fundamental factors that can affect the price of silver both over the short and long term. Traders wanting to profit from price movements in the silver futures market should keep abreast of current economic news and events and have a good understanding of key fundamental pricing factors in the silver market.

Supply and Demand

A decrease in silver production due to labor disputes or higher energy costs can reduce supply, driving prices higher. Alternatively, improved recycling techniques, the liquidation of silver stockpiles, and reduced manufacturing and economic activity can all contribute to higher supply and lower demand, which can drive silver prices lower.

Geopolitical and Geoeconomic Factors

International conflicts, political instability, and other types of negative economic news can create uncertainty and drive silver prices higher as investors purchase silver to safeguard cash assets. Likewise, when the international economic environment is stable and growing, the demand for silver for industrial uses can increase, which can raise prices.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Risks of silver futures trading

Whereas physical silver is a passive investment, silver futures trading entails an active trading approach. It should only be taken on by traders who have researched the fundamentals, understand contract specifications, and have a detailed tested futures trading plan including a risk management strategy.

Like every futures contract, the primary risk of trading silver futures contracts is that the price will go against the trader’s position. Like most other physical commodities, supply and demand dynamics greatly influence the price and volatility of silver futures prices.

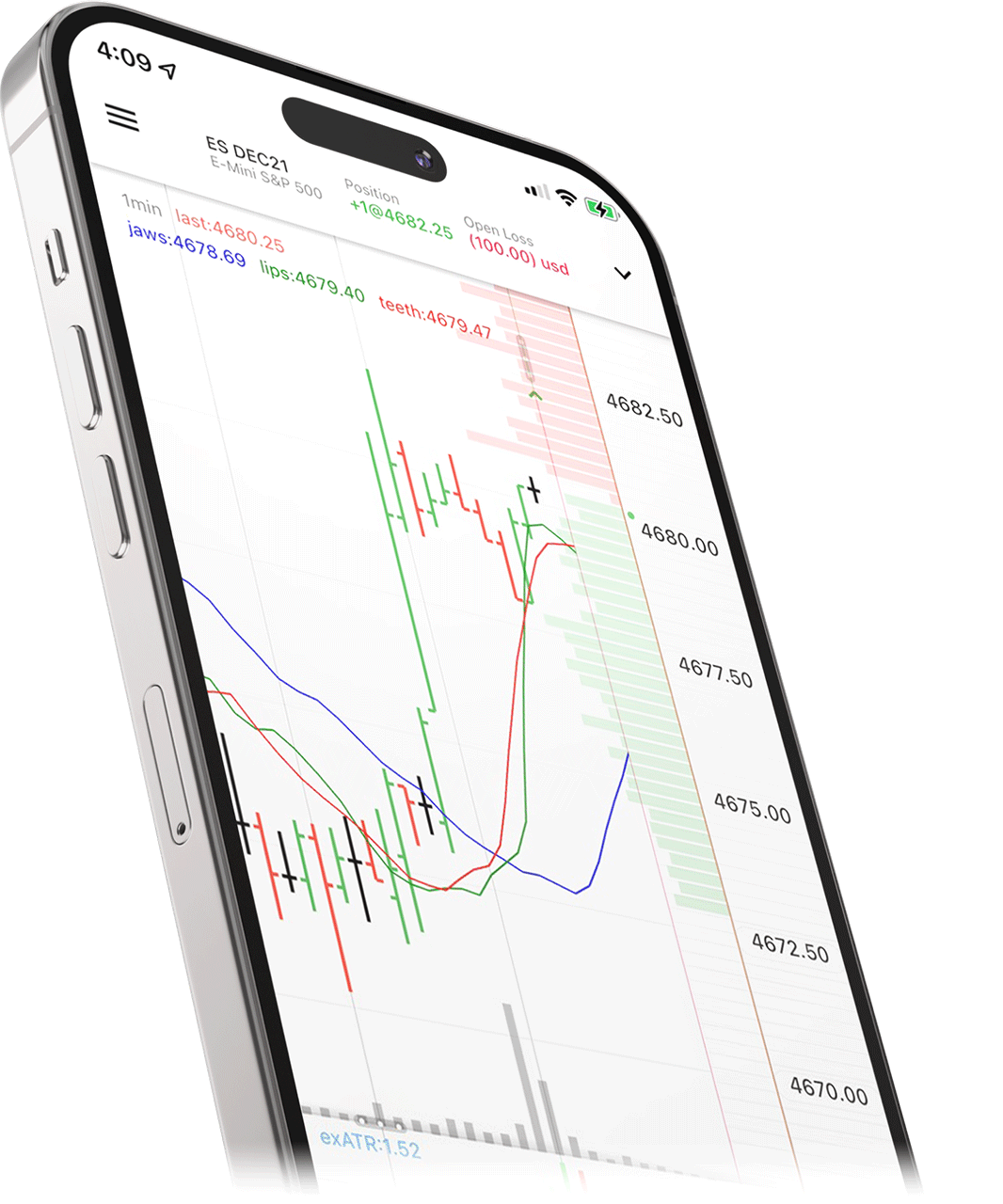

If you're new to futures trading, practicing in a futures trading simulator with live market data can help you prepare for market swings and test your strategy before trading with real money.

Silver Futures Contract Specifications

Silver futures are standardized exchange-traded contracts that represent 5,000 ounces of silver (standard contract) or 1,000 ounces of silver (1/5th Micro contract).

Retail traders typically buy and sell silver futures contracts to speculate on whether the price will go up or down and typically do not want to take delivery of the physical silver. You can trade silver futures on the Chicago Mercantile Exchange (COMEX) on the electronic CME Globex system.

| Standard [Asset] Futures | Micro [Asset] Futures | |

|---|---|---|

| Symbol | SI | SIL |

Exchange | COMEX CME Globex | COMEX CME Globex |

| Contract point value | 5,000 troy ounces | 1,000 troy ounces |

| Minimum price fluctuation | .005, (5000 * .005 = $25.00 per-contract per-minimum move) | .005, (1000 * .005 = $5.00 per-contract per-minimum move) |

| Trading hours | Sunday 6:00 pm ET to Friday 5:00 pm ET | Sunday 6:00 pm ET to Friday 5:00 pm ET |

| Listed contracts | Monthly contracts listed for 3 consecutive months and any Jan(F), Mar(H), May(K), and Sep(U) in the nearest 23 months and any Jul(N) and Dec(Z) in the nearest 60 months | Monthly contracts listed for 3 consecutive months and any Jan(F), Mar(H), May(K), and Sep(U) and Dec(Z) within the nearest 12 months |

| First notice date^ | Last trading day of the month prior to the contract month | Last trading day of the month prior to the contract month |

| Expiration style | Trading ceases at 1:25 pm ET on the third last business day of the contract month | Trading ceases on the third last business day of the contract month |

| Settlement | Deliverable | Deliverable |

| Additional Specifications | View all from CME Group | View all from CME Group |

Become a Silver Futures Trader Today

Ready to start trading silver futures or Micro silver futures? NinjaTrader is here to support you. With award-winning features and daily premium market commentary with industry pros, NinjaTrader equips you with the tools you need to embark on your trading journey.