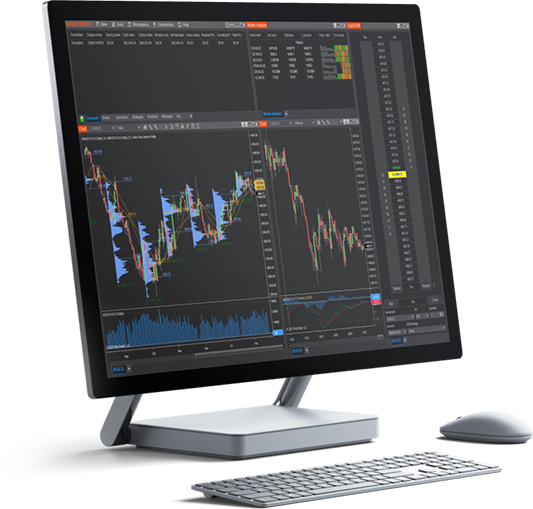

Why Forex Futures Are A Preferred Choice Over Spot FX And CFDs

The forex market, also referred to as the currency market or FX, is the largest capital market in the world, allowing traders to speculate on the exchange rates between major world currencies. Forex futures provide an efficient and effective alternative to trading the spot FX or contract for difference (CFD) markets which introduce a number of pitfalls for traders.

Here we will discuss the various advantages of trading forex futures and currency futures vs spot FX and CFDs, including a well regulated marketplace, transparent pricing and volume and trading on a fair level playing field.

Trade Forex Futures To Capitalize On Currency Market Moves

NinjaTrader offers traders access to all the major foreign currencies traded against the US dollar. Traders can capture potential opportunities in these fast moving markets using a standard futures contract or a Micro sized contact for increased flexibility and reduced capital requirements.

- Australian Dollar (6A)

- British Pound (6B)

- Canadian Dollar (6C)

- Euro (6E)

- Japanese Yen (6J)

Benefits Of Trading Forex Futures Over Spot Forex And CFDs

Fair And Regulated Markets

Futures markets and brokers are highly regulated with all transactions generally consolidated at one exchange. The advantage of a centralized exchange is that orders are matched and guaranteed to be settled. In addition, there is full transparency to contract pricing and volume, allowing traders large and small to compete on a level playing field.

Alternatively, there is no one centralized exchange for spot FX or CFD transactions as they are fragmented across various unrelated forex dealers often with little or no price and volume cross reporting. These trades often occur on a broker’s dealing desk with no counter party guarantees.

Consistent Cost To Trade

In the forex futures market, traders generally pay a commission per-contract, but often the true cost of the trade is expressed in the bid/ask spread which is set by supply and demand and the available liquidity. Most forex futures markets have good liquidity and consistently tight spreads although market conditions may vary. This ensures that traders can enter and exit forex futures trades efficiently and cost effectively.

With spot FX and CFDs, the bid/ask spread is often set by a broker and used to help manage the broker’s risk and drive overall profitability. A spot FX or CFD broker has the ability to take the other side of a trade, transition it to a wholesale pool and lock in a profit. This is why spot FX traders often start a trade with a negative P&L. Additional fees for spot FX and CFD can include per trade commission and overnight interest rate carrying costs.

Diversification

While spot FX traders are often limited to trading one currency against another or a few limited CFD products, futures trading offers a more diverse range of products to diversify and capture unique market opportunities. With futures, you can trade major market indices, interest rates, gold and silver, crude oil and natural gas, agricultural products, and of course forex and currency futures. Why limit what you can trade? This is an important consideration when choosing futures over spot FX and CFDs.

Technical Analysis Made Easy

Build your futures trading foundation using technical analysis to identify trends, support and resistance and key chart patterns.

Benefits Shared By Forex Futures, Spot FX And CFDs

Flexible Trade Sizing

Traders can get started with a small account size due to the ability to limit trade sizing. Trading Micro futures contracts, you can trade futures with margins as low as $50 per contract.

Leverage

Forex futures often provide equal or greater leverage than spot FX. Leverage allows for potentially greater profits but also increased risk. Always trade leveraged futures with a risk management plan in place.

24-Hour Markets

Like spot FX and CFD trading, forex futures trading offers virtually 24-hour trading with good liquidity in many diverse markets - not just forex - so you can place trades in any market on your schedule.

Make The Right Choice For Your Trading Goals

Trading is hard enough, but trading spot FX & CFDs can introduce additional costs and complexity including overnight carrying charges, variable bid/ask spreads designed to work against you, opaque pricing volume, and more.

Alternatively, forex futures provide pricing transparency and a level playing field for all traders whether big or small. Futures market are priced based on buyer and seller supply and demand. When choosing between futures trading and spot FX and CFDs, it’s important to have all the facts.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Best Brokerage for Trading Futures

NinjaTrader is recognized for our unique combination of a high-performance trading platform, discount pricing, and real-time support.

Download NinjaTrader's award-winning software for FREE and see why it's consistently voted an industry leader by the trading community. NinjaTrader is always free to use for advanced charting, backtesting and trade simulation.