For futures traders, proper position management involves understanding margin requirements and handling market exposure accordingly. Being aware of intraday & initial margin requirements, as well as understanding the particular specifications of the contracts you trade, can prevent unwanted position liquidations and potential fees.

Watch a quick-start guide to managing futures margin:

Intraday Position Management

Intraday margin is the minimum account balance required by your broker to maintain a position of one contract (long or short) during trading hours. It is defined per contract and effectively limits how much exposure a trader can assume during a session.

Intraday margin requirements are provided to inform futures traders how much money must remain in an account to trade one contract of a given market. It is the sole responsibility of the trader to stay within intraday margin guidelines. Any violations are subject to liquidation & any associated fees.

For NinjaTrader Brokerage clients, intraday positions must be closed 15 minutes prior to session close. This is 3:45 pm CT for the majority of popular contracts which is 15 minutes before the official session close at 4:00 pm CT.

Overnight Position Management

When holding a position for more than one trading session, there are additional considerations futures traders must take into account. This is where initial margin comes into play, or the minimum account balance required to maintain a position of one contract (long or short) between trading sessions.

Initial margins are set by the respective exchange and represent the amount required to hold a position into the next trading session. Initial margin is also required on holidays when trading sessions span multiple days.

Please note: Intraday and initial margins can be changed by both the exchange and broker especially in times of high market volatility, with limited or no prior notice to traders.

Monitor Margin to Avoid Violations

It is important to remember that stated margin rates are the minimum needed to maintain a position. While position management is up to the individual trader, it is recommended to give a trade ample breathing room to best avoid margin violations.

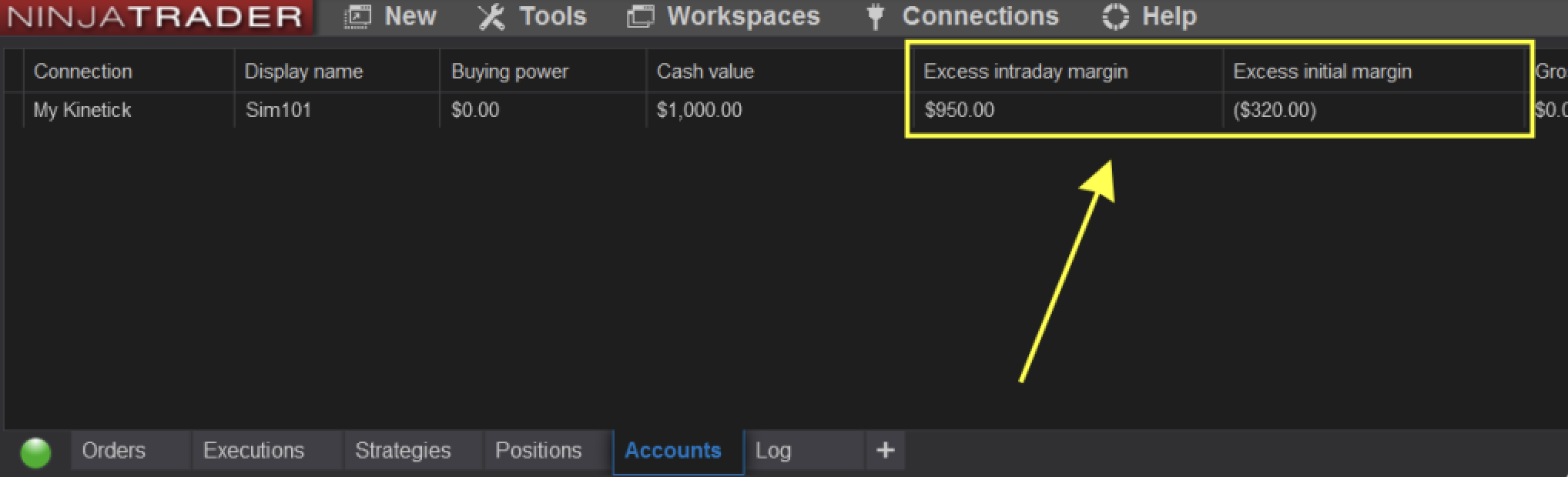

- Tip: Use NinjaTrader’s Excess Margin account display to monitor available margin directly through the platform!

Financial leverage can result in losses greater than the initial margin and traders should be aware of the risks involved in trading futures. Risk management policies are strictly enforced and may result in execution fees as well as higher day-trading margins.

Financial leverage can result in losses greater than the initial margin and traders should be aware of the risks involved in trading futures. Risk management policies are strictly enforced and may result in execution fees as well as higher day-trading margins.

Get Started with NinjaTrader

NinjaTrader supports over 500,000 traders worldwide with award-winning technology, deep discount commissions and industry leading support. The NinjaTrader platform provides traders with state-of-the-art trading charts & market analysis tools.

Ready to start tracking your favorite markets? The NinjaTrader platform is always free for advanced charting, backtesting and trade simulation. Get started with your free futures trading demo today!